Wardlaw's Commitment to the Claims Community: A Legacy of Giving Back Since 1965

Community involvement has always been at the heart of Wardlaw Claims Service. We don't just operate in these communities; we live in them. Our...

2 min read

Wardlaw

Sep 25, 2024 6:01:01 PM

Wardlaw

Sep 25, 2024 6:01:01 PM

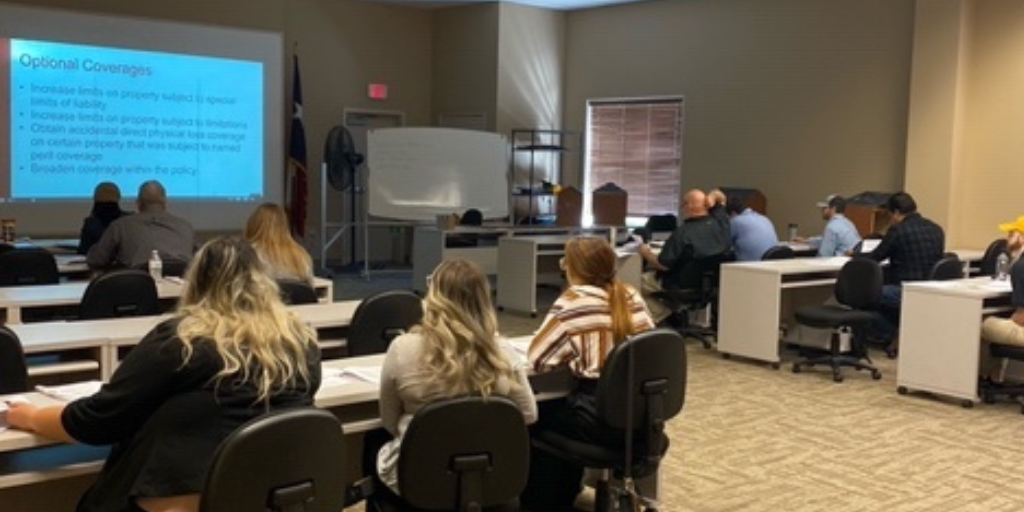

In the ever-evolving landscape of insurance claims, staying current with industry trends, regulations, and best practices is not just beneficial—it's essential. Continuing education (CE) is pivotal in maintaining the high standards of professionalism and expertise that define successful claims adjusters. At Wardlaw Claims Service, we recognize the importance of ongoing learning and encourage our team to view CE as not only a licensing requirement, but as a pathway to career excellence.

For claims professionals, continuing education is generally mandated by state licensing boards to ensure that adjusters maintain their knowledge and skills. These requirements vary by state, but typically include a specified number of CE hours that must be completed within a given timeframe. For example:

These state-specific requirements underscore the importance that regulatory bodies place on ongoing education in our industry. They ensure that claims professionals stay informed about changes in laws, regulations, and industry standards that directly impact their work.

While meeting these baseline requirements is crucial, at Wardlaw, we encourage our team to view CE as an opportunity for growth rather than just a box to check.

Here's why going above and beyond in your continuing education can be transformative for your career:

To maximize the benefits of your CE efforts, consider these strategies:

At Wardlaw Claims Service, we're committed to fostering a culture of continuous learning. We support our team members in their CE pursuits by:

Continuing education is more than just a licensing requirement—it's a critical component of professional growth and excellence in the claims industry. By embracing a mindset of lifelong learning and seeking out opportunities to expand your knowledge beyond the basics, you enhance your career prospects and raise the bar for the entire profession. At Wardlaw Claims Service, we're proud to support our team in these endeavors, knowing that their growth translates directly to better outcomes for our clients and policyholders.

Remember, in the dynamic world of insurance claims, your greatest asset is your knowledge. Invest in it wisely and continuously.

Community involvement has always been at the heart of Wardlaw Claims Service. We don't just operate in these communities; we live in them. Our...

The implementation of percentage-based wind and hurricane deductibles represents one of the most significant structural changes in property insurance...

In the evolving claims management landscape, leading insurance carriers are discovering that the fully remote work model for desk adjusters isn't...